Book Summary of Rich Dad Cashflow Quadrant

My Rich dad used to say."you can never have true freedom without financial freedom."

"Freedom is free ,but it has a price"

Cashflow Quadrant is written by Robert T. Kiyosaki who is the author of the New york times best selling book of Rich Dad Poor Dad. Cashflow Quadrant is all about to set the mindset of rich people to the reader to became rich one day.

Where He divided into people work into four Quadrant.That is

- Employee

where you have a job

-Self Employed

where you own a job

-Business

where you own a system that works for you

-Investor

where money works for you

According to this book.First you have to known which Quadrant you are and where you want to be .If you are in the Left side Quadrant and you want to be the right side than it will be hard due to the emotion you have .The emotion of losing money,afraid to fail and many more .You will ask your self I am old,I don't have money because to make money I need money and many more.

As,a student I have also experience the same what Robert T. Kiyosaki did I realised that I loved learning but hate school.the way that they teach I don't like it.They are just making us to pay tax to government.For 'A' student it was nice places but for the average student like me it wasn't.They were programming all the student to bet in the left side and teach us that money is the root of evil.But in the reality they meed money and do the work that they don't like max people do.

For the Student like me who want to be in the right side of Quadrant school is not the right places to learn because the school crushed the sprit,trying to motivate with the emotion of fear:the fear of making mistake,the fear of failing,and the fear of not getting a job(The person who never make mistake will never learn anything new -Einstein)

This may be way so many entrepreneurs never finished school.

"Changing quadrant is often a change at the core of who you are."The Difference between the Rich and Everyone Else.

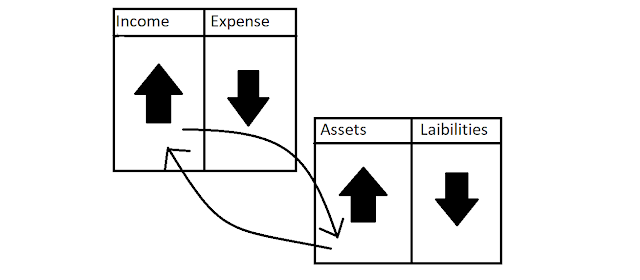

A few ago,Robert T. Kiyosak read an article that said most rich people receive 70% of their income from investment ,or the I Quadrant ,and less than 30% from wages,or the E Quadrant if they were an E,chances are that they were employees of their own corporation.their income look like this;

For most everyone else,the poor and the middle class,at least 80% of their income comes from wages from the E & S quadrant,and less than 20% from investment in the I quadrant.

The Three kind of Business systems

"Your goal is to own a system and have people work that system for you"Robert T. Kiyosaki said there are three kinds of business systems.They are

- Traditional C corporations-where you develop your own systems

- Franchises-where you buy an existing systems

- Network marketing-where you buy into and become part of an existing systems

Where,Robert T. Kiyosaki say will building a companies you may lose two or three companies but "failure is a rich teacher " because we can learn many things with our failure.Some knowledge very important that even the Billioner can't teach us but "success's is a poor teacher" because we learn most about ourselves when we fail,so"Don't afraid of failing.Be afraid of not trying again."

The Five Levels of Investors

"Investing is the key to Financial freedom."Robert T. Kiyosaki poor dad often said,"Investing is risky."

And his rich dad often said,"Being financial uneducated is risky."

Today,most people known they should invest.The problem is that most people,like Robert T. Kiyosaki poor dad,believe investing is risky - and investing is risky when you don't have any financial education,experience,and guidance.

There are Five types or levels of Investors found in the I quadrant.

- Level 1:The Zero-Financial-intelligence Level

There are many people who make a lot of money who fall into this category.They earn a lot and spend more than they earn.They buy things thinking that they are assets but the reality is the things they buy are liabilities.They buy things how the school teacher say that it is assets but in real life it is not.Due to the lack of real financial education people think investment is risky.

- Level 2:The Savers-Are-Losers Level

"It is not how much money you make or save,it's about how much your money work hard for you"-Biyaku

Many people believe it is smart to save money.The problem is that today,"money" is no longer money.Today,people are saving counterfeit dollars,money that can be created at the speed of light.

Money value is decreasing day by day.Remember,in 1971 gold was $35 an ounce.Forty years later,gold was $1,400 an ounce.That is a massive loss of purchasing power for the dollar.Today,savers are the biggest losers.

- Level 3:The I'm-Too-Busy Level

- Level 4:The I'm -a-Professional Level

The do-it-yourselfer has very little,if any,formal financial education.After all,if they can do it themselves,why should they learn anything?

If they do attend a course or two,it is often in a narrow subject area.For eg, if they like stock trading,they will focus only on stock trading.The same is true for the small real state investor.

The following are some of the basic-picture asset classes rich dad wanted Robert T. Kiyosaki to spend his life learning.

- Level 5:The Capitalist Level

As started earlier,the Level 4 investor is the do-it-yourself from the S quadrant investing in the I quadrant.

Note;The Level 5 investor generally use OPM ( other people money) to invest.The Level 5 investors have real financial education and read business and investment books.

If you want to read Rich dad cash flow Quadrant in pdf than,Click here

Who pay to take the risk?

People on the Left side quadrant pay to take risk and the people on the Right side quadrant are paid to take risk.

For eg;People on the left side pay insurance company to prevent from risk and pay you for that privilege.they just assume that everything is risky,and they pay for it.

The Seven Steps To Finding your Financial Fast Track

Kim and Robert T. Kiyosaki used these seven step to move from being homeless to financial freed in just few short years.The seven steps are

STEP 1:It Is Time To Mind Your Own Business

"We are programmed to mind everyone else's business,and ignores our own ."Have you been working hard and making everyone else rich?Starting early in life,most people are programmed to mind others people business and other people rich.

STEP 2:Take Control Of Your Cashflow

"People who cannot control their cashflow work for those who can."Many people believe that making more money will solve their problem but it is not true.

The primary reason of having money problem they where never teach to control their cashflow in the first.Without training they wind up having money problem and start to do over time by thing will solve their problem.

As,rich dad said,"More money will not solve the problem if cashflow management is the problem."

STEP 3:Known The Differences Between Risk And Risky.

"Business and investing is not risky,being uneducated is."Proper cash flow management is necessary to find it is risky or not.It being with kn owning the difference between assets and liabilities.I am not taking about what school teach about assets and liabilities because they say house is assets.yes it is true but it not assets for us it is assets for bank and government.They are teaching us to do the cashflow of government and companies not for our self.The followings cashflows the properly managed of an individual who is 45 years old.

STEP 4:What Kind of Investor You Want To Be

"Start Small And Learn To Solve Problem"Have you ever wonder why some investor with lot less risk than other? Most people struggle because they avoid financial problems.One of the biggest secret my rich dad taught about was this:If you want to acquire great wealth quickly ,take on great financial problems.In above,we discussed about 5 Level of investor.I would like to add more distinction that define three types of investors:

- Type A:Investor who seek problems.

- Type B:Investor who seek answers.

- Type C:Investor who seek an "expect" to tell them what to do.

STEP 5:Seek Mentor

"A Mentor Is Some One Who Tells You What Is Important And What Is Not Important."Mentor will guides you to the way you never go before.Like a Basketball player need coach to train.In business their comes troubles which is already solve by many rich people (we do not need find a answer again if it is already solve) which by making them mentor it will easy to move froward in business and investment.

STEP 6:Make Disappointment Your Strength

"Inside Every Disappointment Lies A Priceless Gem Of Wisdom"When Robert T. Kiyosaki was salesman he was the worst one in the company for two years he could sell properly and blame the failure into economy,the product he try to sell and the customer .

In order to learn sell ,he had to face the pain of disappointment at the process he learn something priceless that is how we can turn disappointment into assets rather than liabilities.If you are learning something than "Be prepared to disappointment" because failure is the teacher which has unlimited knowledge to learn.

STEP 7:The Power Of Faith

"The Only Person Who Determine The Thoughts You Chooses To Believe About Yourself,Is You"If you don't believe in yourself than nobody will do even your mom, dad,sister ,brother, friends, and others.You can say that it is the gift of god that we can believe in our self and keep moving froward .In the Business world their will be lots of problems and you will be only one to solve and nobody will be there in the road of success.Yes there you could be lucky if you have some to push you .But it will be hard when you question your own believe than it will be over for you.

Take Action

Believe in yourself and start today.

If you want to Richdad Cashflow Quadrant than,Click here

Comments

Post a Comment